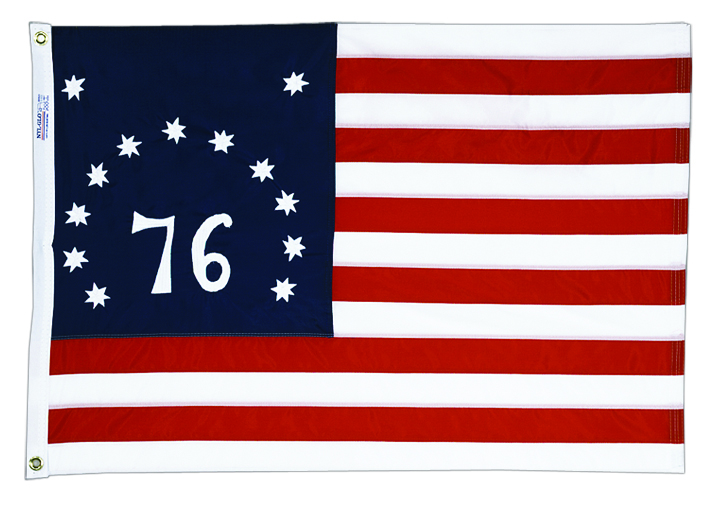

Burgoyne, the British General operating in northern New York, in the Revolutionary War, heard that the Americans had collected some military supplies at Bennington, Vermont. He sent an expedition of 1,000 men to capture them. Colonel John Stark, a hero of Bunker Hill, set out with 2,000 Americans to oppose the British. They fought under the Bennington Flag. When Stark saw the British advancing down the road, he pointed them out to his brave troops and said: “Boys, there they are. We beat them today, or Molly Stark’s a widow.” The Green Mountain Boys, fighting Indian fashion, practically annihilated the British Regulars.

Only about 100 of them ever got back to Burgoyne’s Army. It was the loss of these 900 men that contributed much to the failure of Burgoyne’s campaign, which ended in disaster with the surrender of his Army at Saratoga, New York, October 7, 1777, a death blow to the British. The Bennington Flag was presented to Colonel Stark’s Army by Nathaniel Fillmore, the father of the future President. It was made of homespun linen and hand sewn.

Made in the USA, 3 x 5, outdoor high quality made by Annin. Cost is $39 NO TAX, Free Shipping. To order this flag, please enter $39 below as your donation amount. You may donate more, but the minimum is $39.

Expert Craftsmanship! SEWN stripes using double-needle LOCKSTITCH with 4 ROWS on the Fly Hem and Back Tack reinforcement. Vivid WHITE STARS are densely EMBROIDERED for beautiful presentation. Two STRONG Brass Grommets.

100% Made in the United States! U. S. law requires every American flag to be labeled with its country of origin. The FMAA “Certified Made in the U. S. A.”

eFundID Account Login

eFundID Account Login

Sign in for one-click donating.